Get ready to master your money game! Say goodbye to 'I can't afford that' and hello to freely spending your money while crushing your financial goals.

Cash Confident:

Everything You Need To Be Good With Money

The Flexible Budgeting Formula For Avoiding A Zero Bank Balance While Spending More on What You Love

YES, I NEED THIS!

- Always have the budget to say yes without second-guessing. Learn how to manage your money in a way that never has you saying "I can't, I'm broke" again.

- Check your bank account without anxiety. With your new money management skills, you’ll always know that there’s more than enough left in your bank account, giving you peace of mind and financial security. No more month left at the end of your money.

- Find extra money to spend on the things you love. By identifying and eliminating unnecessary expenses, we free up resources for the things you truly love—ensuring your bank account stays healthy and far from zero.

- Grow your savings effortlessly. No more starting each month wondering if you’ll have a little extra to save. We’ll show you how to consistently grow your savings account.

And SO much more!

Are you checking your bank account with a sigh as the month's only half over?

Imagine this: It's the middle of the month and, instead of your balance nearing zero, you're comfortably planning your next purchase. Sounds like a stretch? It's not.

You're not alone if your money seems to vanish without a trace, leaving you anxious about every upcoming bill. It's frustrating when your savings attempts are disrupted by yet another "necessary" withdrawal.

Maybe you’ve tried budgeting before but found it too restrictive, taking the pleasure out of your spending. If this sounds all too familiar, you’ve likely been trapped by an ineffective strategy.

It’s time for a change.

What if you could manage your finances freely

without giving up your daily lattés or avocado toast?

Believe it or not, being savvy with your finances doesn't mean cutting out everything you love. You can live well and still see your bank balance grow.

Because let’s face it: you want to be responsible with your money, but you also want to live your life to the fullest—and yes, that means spending money.

I’m here to tell you that you CAN have your cake and eat it too. You can spend like royalty without watching your bank balance plummet to zero way before payday. And inside Cash Confident... you'll learn exactly how!

Here, we tackle budgeting in a DIFFERENT, non-restrictive way. It’s the secret to becoming financially savvy, allowing you to spend MORE on what you love, and finally kicking that dreaded “where did all my money go?” feeling to the curb.

Spend On What You Love Guilt-Free

Forget the days of talking yourself out of purchases with "you don't REALLY need this". If it brings you joy, it’s yours.

Effortlessly Make It To The End Of The Month

No more month left at the end of your money. Glide through to the end of each month without giving up the small luxuries you adore.

Grow A Thriving Savings Account

Forget the days of constantly tapping into savings for unexpected bills. Learn to build a buffer that keeps you secure and lets your savings grow smoothly.

The Non-Restrictive Budgeting Method That Avoids A Zero Bank Balance While Spending More on What You Love.

Here's everything that is included in this bundle:

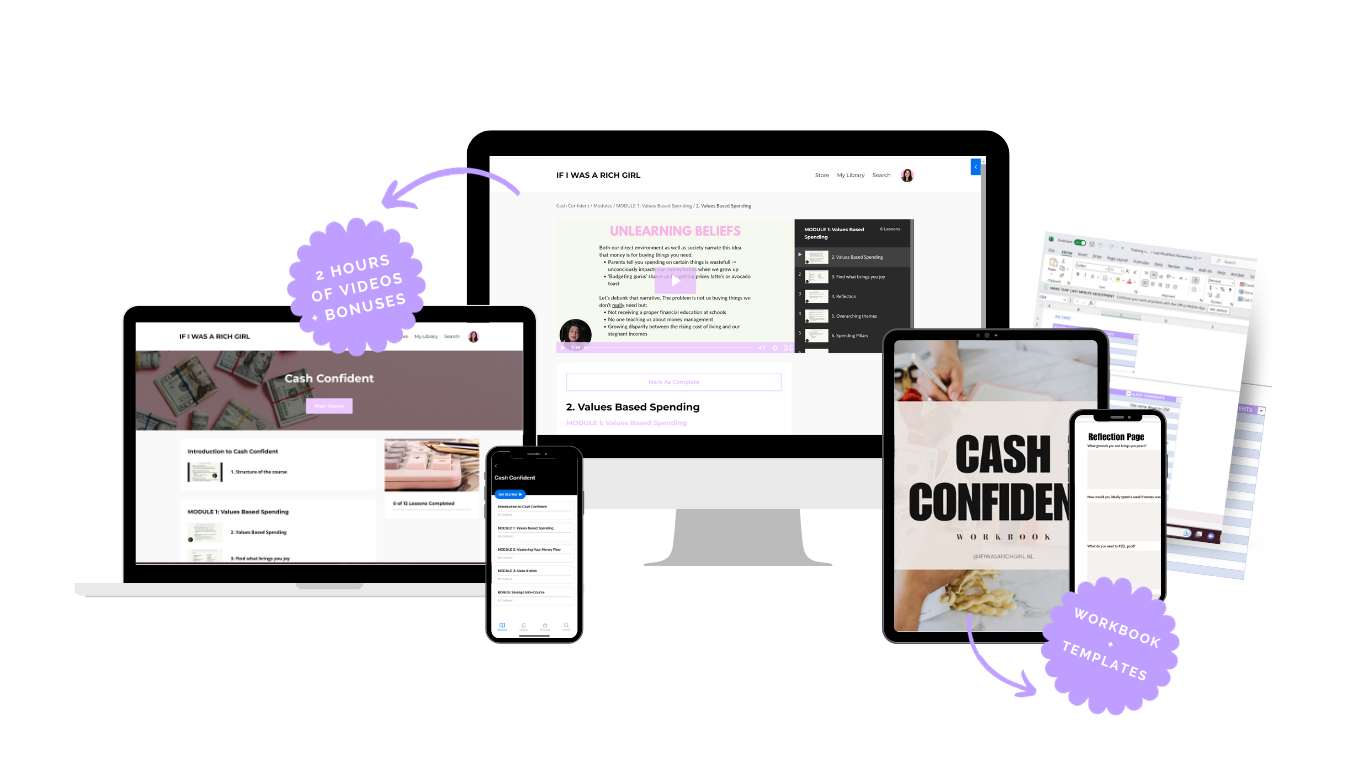

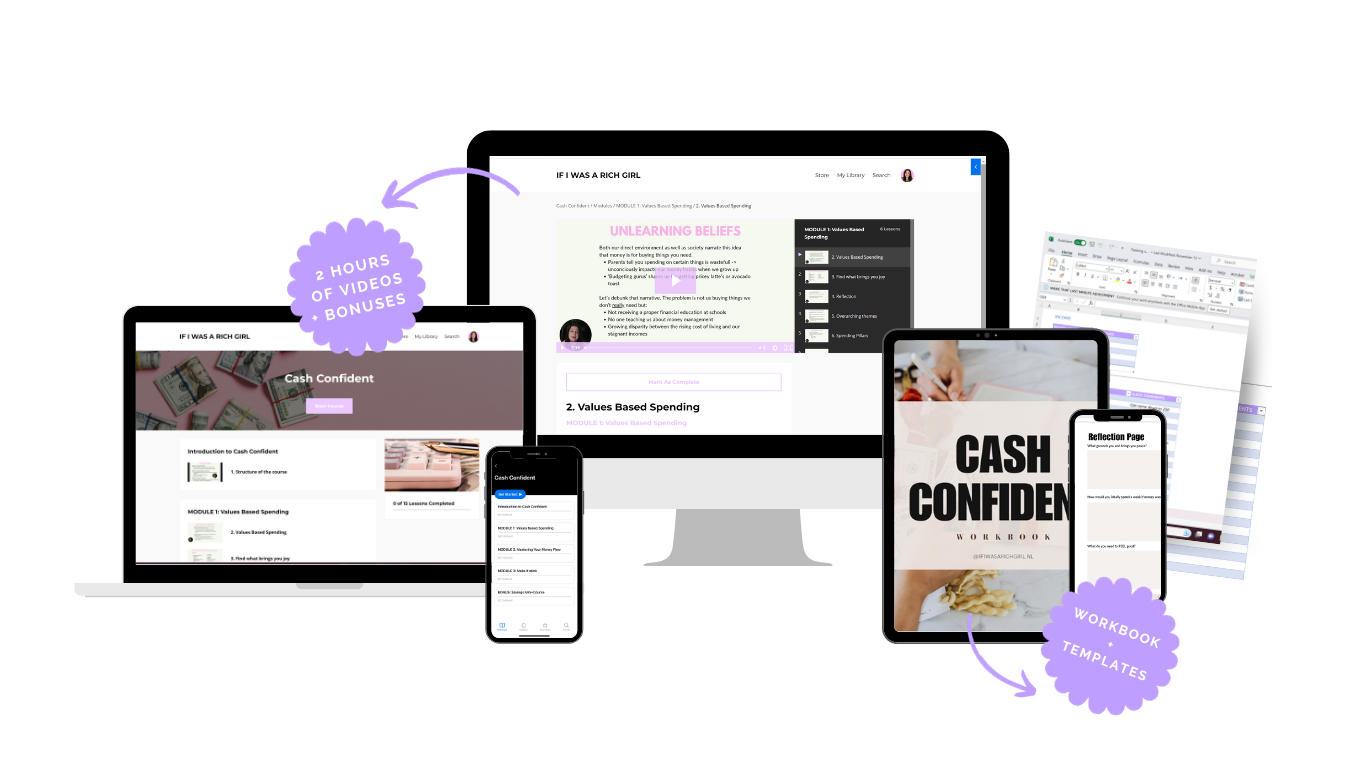

1. Cash Confident Method

Learn to handle money like a pro. More than 2 hours of video lessons will change your financial life forever by teaching you our exclusive Cash Confident Method. Value: $200.

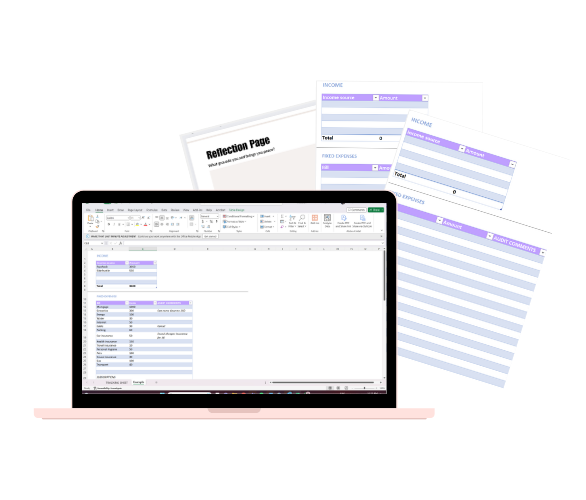

2. Fixed Expenses Audit

This audit shows you exactly where your cash is going and how you can easily find extra cash (this resource alone saved one of our students $400 per month!!!) Value: $150

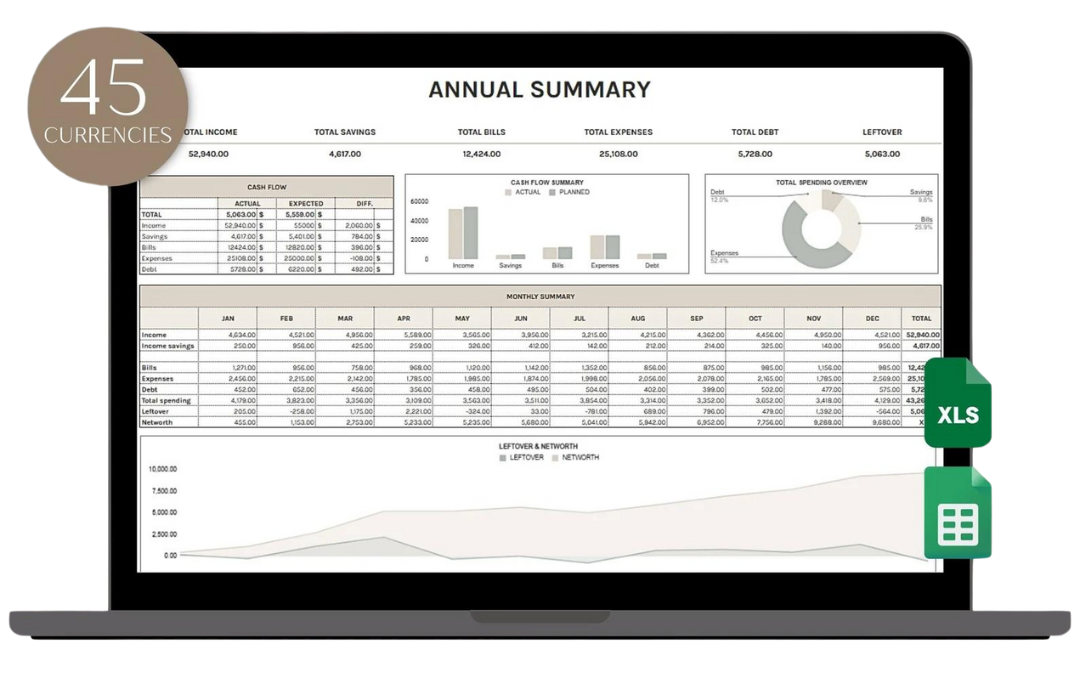

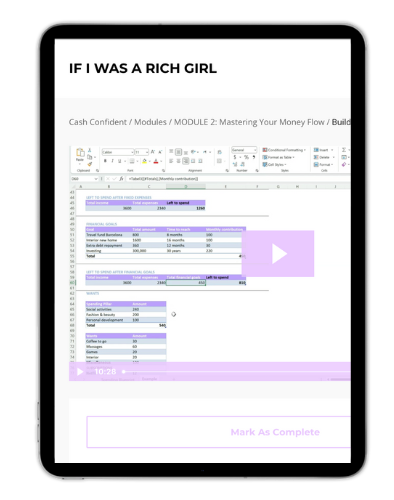

3. Monthly + Annual Budgeting Template

We've enhanced the bundle with tools designed to simplify your budgeting! Our new template not only provides an instant monthly overview but also automatically converts this into an annual summary. Now, you can track your budget throughout the year effortlessly and efficiently. Value: $50

4. Spending Blueprint

Build a budget you'll actually enjoy. This tool helps you create a plan based on what makes you happiest, allowing for guilt-free spending. Value: $50

5. Cash Workbook

Provides simple exercises and direct questions to help you uncover and understand your spending patterns. Learn where you might be overspending and how to redirect funds towards what truly enriches your life Value: $80

6. Budget Evaluation Toolkit

Make your budget work for you. These exercises and roadmaps for your money dates help tailor your financial plan to your life, not the other way around. Value: $80

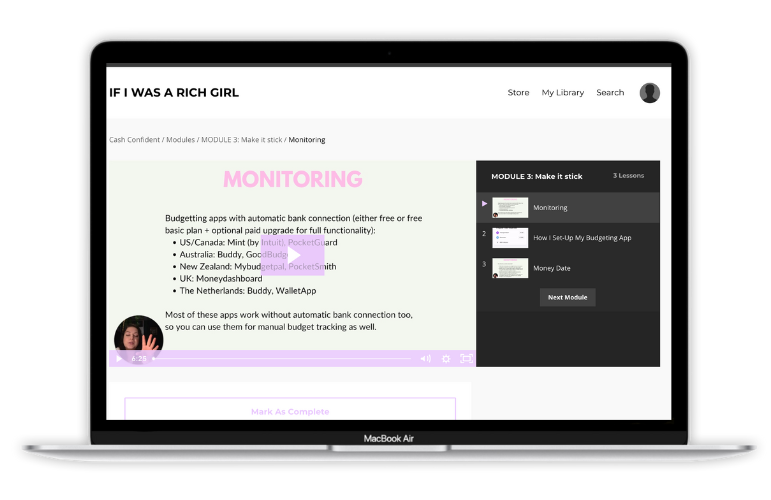

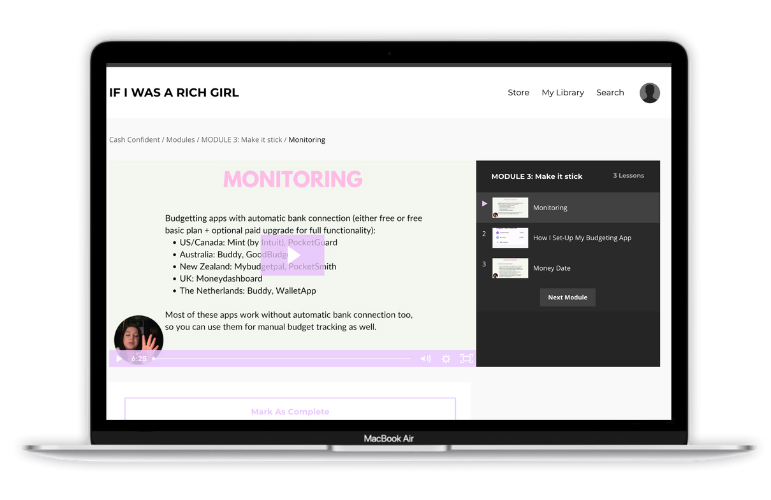

7. Budgeting Apps

Apps simplify your financial management (and we like easy and fast). We've selected the best apps to make maintaining your budget effortless and filmed walk-throughs so you know exactly how to track your budget FAST Value: $20

8. BONUS: Course on Amplifying Savings

It's time to grow your savings! In this savings mini-course, you'll learn strategies to meet your savings goals and keep your funds intact—no more withdrawing from savings for unexpected bills. PLUS, discover how to earn more money in interest over your savings! Value: $120

9. BONUS: High-Growth Savings Account

Pick a savings account that actually grows your money. We show you which type of accounts offer the best returns.

10. BONUS: Investing Masterclass

Now that you have more money to save, it’s time to talk about making it grow! Investing is a crucial component of any personal finance journey. It doesn’t need to be risky, complicated, or time-consuming. In this investing masterclass, you’ll learn the basics of investing with as little as 50 dollars. Value: $150

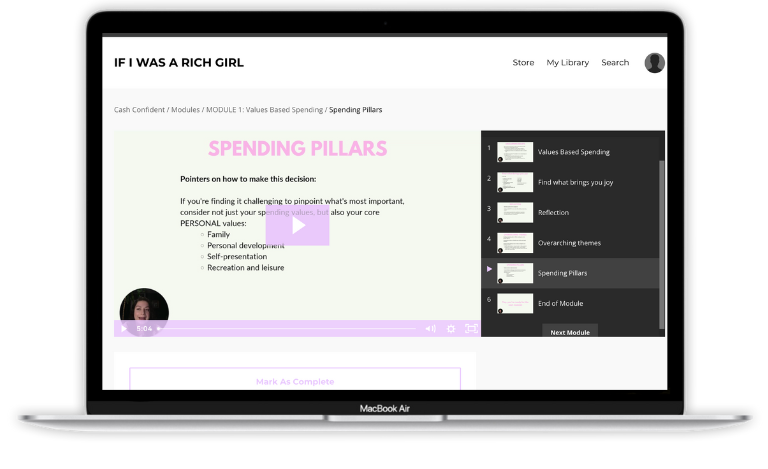

And here's a step by step overview of what you're going to learn:

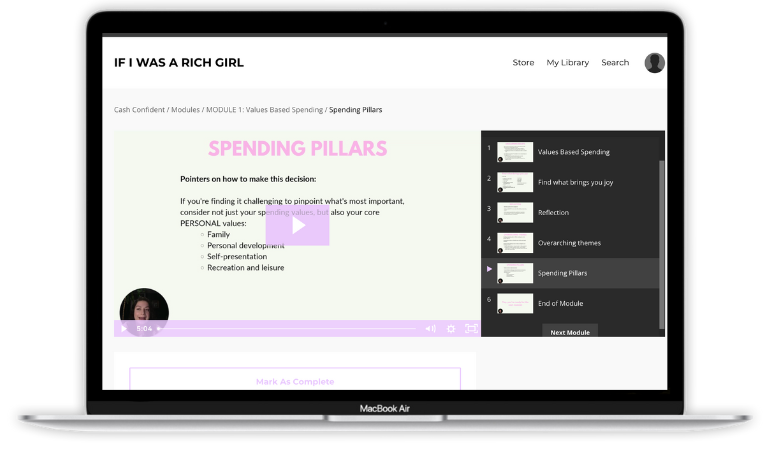

We start off by gaining crystal-clear insight into your spending habits. We'll distinguish between expenses that genuinely enhance your life and those that aren't really doing anything for you. The strategies we develop here are key to crafting a budget that feels liberating, not limiting, preventing any sense of restriction as you move forward.

Discover exactly where your money is going with eye-opening clarity. These resources will have you saying, "Oh my gosh, am I really spending this much on xyz?" By identifying and eliminating unnecessary expenses, we free up resources for the things you truly love—ensuring your bank account stays healthy and far from zero!

Creating a budget is one thing... sticking to it is another. No more broken financial promises! In this part of the course, you'll master key strategies that make adhering to your budget feel effortless. We provide a plan that integrates smoothly into your daily life, is simple to maintain, and saves you time—all ensuring your financial success sticks.

A recap of everything waiting for you inside

-

Cash Confident Video Lessons Value: €200

-

Fixed Expenses Audit Value: €150

-

Instant Money Tracking Sheet Value: €50

-

Spending Blueprint Value: €50

-

Workbook Value: €80

-

Budget Evaluation Toolkit Value: €50

-

Money Date Cheat Sheet Value: €30

-

Essential Budgeting Apps Value: €20

-

Mini-Course on Amplifying Savings Value: €120

-

High-Growth Savings Account Advice

-

Investing Made Simple Value: €150

Money Back Guarentee

Try the course risk-free, for 14 days.

We're pretty sure you're going to love the program. But we want to make this a no-brainer for you.

If you're not 100% satisfied with this program, we will gladly refund every penny you paid for it if you contact us within 14 days. No strings attached.

Read what fellow Cash Confident students have said about their experience inside the program...

Why am I the best person to help you with your money?

Hi, my name is Sepiedeh, your go-to Personal Finance Coach. I could say I've been in your shoes, but honestly, I've probably been in worse spots. 🥴

For most of my life, my relationship with money was a disaster. Imagine starting university already swamped with debt—credit cards, student loans, the works. Half my paycheck vanished before it even reached my bank account, and despite earning as much as my friends, I couldn’t afford the same luxuries.

Then 2020 delivered a wake-up call. I had to move because my apartment was being demolished, leaving me with a stark choice: transform my finances and buy my own place, or get stuck in a costly rental, trapped in the same old financial rut.

I chose transformation. I overhauled my spending habits and within a year, cleared my high-interest debt and saved over $15,000 for my dream home’s interior. Even better? I enjoyed holidays, dinners out, and treats without feeling deprived.

In the midst of a housing crisis and a global pandemic, I purchased my dream home in an ideal location.

Now, I’m sharing my signature money framework worldwide through If I Was A Rich Girl, a brand dedicated to helping others take control of their finances and enjoy life without feeling financially restricted.

Is Cash Confident for you?

-

Watching your account hit zero before month-end.

-

Turning down the things you want because they seem out of reach.

-

The frustration of not knowing where your hard-earned money goes.

-

Staring at an empty savings account, wishing things were different.

- Watching your bank balance stay healthy all month long.

- Enjoying the things you love without financial worry.

- Always knowing where your money is going with clarity and confidence.

- Seeing your savings account flourish as you build your financial future.

But let's think about this for a moment:

How often has your income actually increased? From the pocket money of your youth to your first real paycheck, or even when you landed that big, grown-up job—did those jumps in income ever really feel like enough to live your dream life?

Probably not, right?

Here’s why:

It’s not just about how much you earn. The true game-changer is how you manage what you have. Without proper money management skills, no increase in income will ever feel sufficient. Even millionaires can find themselves struggling if they don’t know how to effectively manage and retain their wealth.

Are you ready to gain the skills that will bring you a lifetime of wealth, regardless of your income level?

Frequently Asked Questions

How long do I have access to the material?

Where do I follow the course?

I’ve tried budgeting before and it wasn’t for me/I couldn’t stick to the budget/I felt too restricted. How is this course different?

Is there an opportunity to receive feedback on my personal situation?

I actually make enough money to not hit zero on my bank balance at the end of the month. Is this course still for me?

I live paycheck to paycheck. How can this course help me?

What if the course doesn't meet my expectations?

A recap of everything waiting for you inside

-

Cash Confident Video Tutorials Value: €200

-

Fixed Expenses Audit Value: €150

-

Instant Money Tracking Sheet Value: €50

-

Spending Blueprint Value: €50

-

Workbook Value: €80

-

Budget Evaluation Toolkit Value: €50

-

Money Date Cheat Sheet Value: €30

-

Essential Budgeting Apps Value: €20

-

Mini-Course on Amplifying Savings Value: €120

-

High-Growth Savings Account Advice

-

Investing Made Simple Value: €150

Money Management is a SKILL FOR LIFE

Learning how to manage your money doesn't have to be intimidating. I poored my entire heart into this course to make sure that you get to have this life-long skill that will allow you to build true wealth, no matter where you are on your journey or income level. Whatever your dreams are, they most likely cost money. And being confident with your money is the key to achieving them. Let's unlock your financial potential together!

SAY NO MORE! I'M IN!